Need to keep on prime of the science and politics driving biotech at this time? Enroll to get our biotech publication in your inbox.

Whats up, everybody. Damian right here with an in depth learn of the most recent blockbuster deal, a have a look at Novartis’ multibillion-dollar gamble, and a reminder of what Vertex Prescribed drugs does effectively.

The necessity-to-know this morning

- Eli Lilly reported fourth-quarter earnings and income that topped Avenue consensus. Gross sales of Mounjaro, Lilly’s GLP-1 medication for diabetes, totaled $2.2 billion versus $1.7 billion consensus. The identical drug, lately accepted as Zepbound for weight problems, had gross sales of $176 million. For 2024, Lilly is forecasting income within the vary of $40.4-41.6 billion, greater than present Avenue consensus.

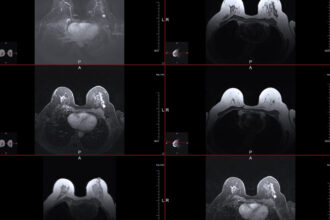

- Lilly additionally reported outcomes from a Section 2 research of tirzepatide (Mounjaro/Zepbound) within the fatty liver illness generally known as MASH, exhibiting 74% MASH reversal with out worsening of fibrosis in comparison with 13% for placebo — statistically vital for the research’s major objective. Lilly stated tirzepatide additionally confirmed a “clinically significant” discount in liver fibrosis, a key secondary endpoint, however missed statistical significance.

Is promoting stuff to biotech an excellent enterprise?

Contemplate yesterday’s large deal, through which Novo Holdings paid about $17 billion for the pharma contractor Catalent after which flipped three of the corporate’s vegetation to Novo Nordisk, through which it owns a controlling stake.

On the one hand, the deal suggests there’s cash to be made in promoting manufacturing providers to drug corporations, or else Novo Holdings wouldn’t have purchased Catalent in its entirety. Then again, it suggests drug corporations may be higher served by doing all their manufacturing in-house, or else Novo Nordisk wouldn’t have purchased these vegetation for its unique use.

As STAT’s Matthew Herper writes, the seemingly contradictory transaction is a neat snapshot of how the drug business works in 2024. For all their latest points, contract producers are nonetheless worthwhile for many drug corporations, whose altering wants make it extra prudent to outsource sure providers fairly than pay to keep up them internally. However Novo Nordisk isn’t most drug corporations. The Danish agency can’t appear to make sufficient Ozempic and Wegovy to fulfill demand, and thus paying billions of {dollars} to personal the technique of manufacturing makes financial sense.

Learn extra.

Novartis, MorphoSys, and a multibillion-dollar wager

Novartis agreed to pay about almost $3 billion for German drugmaker MorphoSys, a deal that matches with the Swiss firm’s oft-repeated need to purchase issues that price lower than $5 billion however nonetheless represents a large gamble.

That’s as a result of MorphoSys’ most mentioned drug, a blood most cancers remedy referred to as pelabresib, is hardly a positive factor. Final 12 months, the drug met its major endpoint in a myelofibrosis research, lowering sufferers’ spleen quantity relative to placebo. However MorphoSys’ therapy had no vital advantages on a measure of sufferers’ signs, one thing the corporate had beforehand stated can be required to win regulatory approval.

MorphoSys is betting the FDA will look favorably on pelabresib regardless of its blended medical knowledge. Novartis, by agreeing to accumulate it, is staking billions of {dollars} on that notion. What’s curious is why Novartis, which has loads of money to spend, would act rapidly as a substitute of ready till regulators weigh in and supply a clearer image of pelabresib’s future.

Learn extra.

Vertex nonetheless is aware of the right way to make CF medication

After all the talk over Vertex Prescribed drugs’ deliberate future in treating ache, the corporate got here by means of with an anticipated however no much less appreciated reminder of what it does greatest.

Vertex’s once-daily cystic fibrosis remedy succeeded in a pair of Phase 3 studies that in contrast it to Trikafta, a blockbuster therapy that requires two doses per day. A 3rd research discovered the drug was secure and efficient for sufferers as younger as 6.

The drug’s success units the stage for regulatory filings later this 12 months. If accepted, the once-a-day therapy would prolong the corporate’s dominance out there for cystic fibrosis remedies and meaningfully scale back its royalty obligations. The information despatched Vertex’s share worth up about 2% after hours yesterday.

One thing’s knotty in Denmark

About yearly, one thing occurs in biotech that leads everybody to seemingly study anew that Novo Nordisk has a bizarre possession construction. Yesterday, when Novo Holdings purchased one thing and offered a part of it Novo Nordisk, was a chief instance.

Right here’s how it works: The Novo Nordisk Basis, a charitable group price greater than $100 billion, owns 100% of Novo Holdings, a holding firm that retains minority stakes and majority voting energy within the drugmaker Novo Nordisk and the economic biotech agency Novonesis. This could all be much less complicated if all of the Danes concerned didn’t insist on naming all the pieces “Novo,” however right here we’re.

What’s novel is a priority about battle of curiosity. As soon as yesterday’s deal closes, Novo Holdings will management what’s left of Catalent, an organization that sells providers to different drug corporations, a few of which compete with Novo Nordisk. As biotech investor Brad Loncar wrote, “in case you are a buyer of Catalent, would you like its new proprietor to be an funding agency who naturally has one of the best curiosity of one other drug developer prime of thoughts?”

The deal, anticipated to shut later this 12 months, may make the FTC the subsequent social gathering to study extra concerning the many Novos of Denmark.

Extra reads

- Diabetes remedies have improperly listed patents that must be eliminated, evaluation finds, STAT

- U.S. invoice poses danger to Wuxi AppTec and its Western drugmaker companions, Reuters

- The lone Democrat prepared to weaken Medicare’s energy to barter drug costs, STAT

- Gene enhancing startup Metagenomi lastly units IPO vary, Endpoints