Want to stay on top of the science and politics driving biotech today? Sign up to get our biotech newsletter in your inbox.

Hello, everyone. Damian here with a rebound for biotech stocks, the potential of Wegovy, and a major change at the FDA.

The need-to-know this morning

• Abbvie said it would acquire ImmunoGen, a maker of cancer drugs, for $10.1 billion. ImmunoGen is being acquired for $31.26 per share, or a 95% premium to its Wednesday closing price. The company markets an antibody-drug conjugate called Elahere used to treat ovarian cancer.

Biotech is crawling back

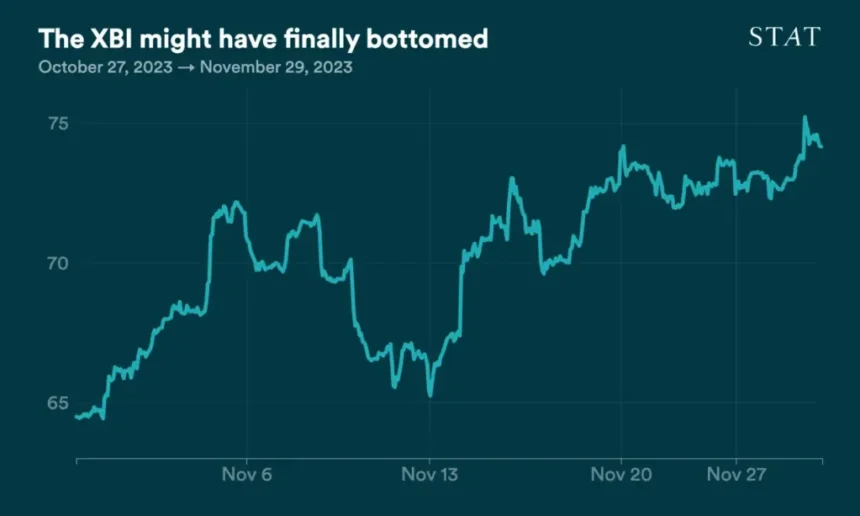

After hitting a five-year low in October, the closely watched XBI biotech index has rebounded in fits and starts over the last month, driven by some reassuring macroeconomic news and a prevailing sense that things simply couldn’t get much worse.

The index picked up in mid-November on the news that inflation had pretty much flattened, suggesting the Federal Reserve is almost certainly done raising interest rates and might even start cutting them, which is generally good news for market sectors perceived as risky, of which biotech is one. The XBI has risen another 4% since then.

Biotech is still down about 9% on the year, and it’s more than 20% off of its 2023 peak. But there’s a growing sense among investors that many biotech companies have fallen so far as to be undervalued, according to TD Cowen’s recently “sentimentometer,” lending weight to the theory that the market might pick back up in early 2024.

Do GLP-1s have a future treating alcoholism?

The rosiest of revenue projections for treatments like Wegovy and Zepbound rely on a future in which their use goes beyond diabetes and obesity and into Alzheimer’s disease and substance use disorders. But GLP-1 drugs’ pathway to pharmaceutical ubiquity is a little cloudier than it might seem.

Take for example alcohol use disorder, or AUD. This week, a case study published in the Journal of Clinical Psychiatry reported that six patients diagnosed with AUD received Wegovy for weight loss and experienced significant reductions in their symptoms, sparking more interest in the potential of GLP-1 treatments in addiction. According to Leerink analyst David Risinger, there are at least six other mid-stage studies testing whether Novo Nordisk’s drug can treat AUD or nicotine dependence, each reading out in the coming years.

The problem is that not one of those studies is sponsored by Novo, which has been noncommittal about running the costly, large-scale trials that would be required to win FDA approval in addiction. Physicians could prescribe a GLP-1 drug off-label, but manufacturers are already struggling to meet demand for patients with diabetes or obesity, leaving little supply for speculative indications.

The U.K. has a lot of genomes

There are 500,000 of them, to be exact, when counting the latest tranche of genomic data collected in the U.K. Biobank, a 20-year project designed to be the most exhaustive resource in the world.

As STAT’s Andrew Joseph reports, the Biobank consists not only of whole genome sequences but also survey responses about patients’ health, medical records, tests of molecular markers, and imaging scans. The idea is to help the researchers who pay to use the Biobank to correlate patients’ genomic information with other data, potentially spotlighting warning signs for disease or identifying variants that might prove to be protective.

“The scientists are looking at this like Google Maps,” said Rory Collins, Biobank’s principal investigator. “When they want to know, what are the pathways from lifestyle, environment, genetics to disease, they don’t go to Google, they go to U.K. Biobank.”

Read more.

FDA picks Woodcock’s replacement

With Janet Woodcock, a superlatively influential regulator, slated to retire from the FDA next year, the agency has chosen its current chief scientist to take on her role of principal deputy commissioner.

As STAT’s John Wilkerson reports, Namandjé Bumpus will succeed Woodcock in a role that presides over the FDA’s entire operation, where her priorities will include reorganizing of the agency’s food division and the the office that inspects manufacturing facilities for drugs and medical devices. Bumpus joined the FDA as chief scientist in June and was previously a professor and chair at Johns Hopkins University School of Medicine’s department of pharmacology and molecular science.

Woodcock’s departure, slated for early 2024, will end a four-decade career at the FDA that included more than 20 years in charge of its drugs division, a role that made her one of the most powerful people in the agency.

Read more.

More reads

• Cigna, Humana in talks to merge into health insurance giant, per report, STAT

• Fortrea disputes Acerlyrin statements regarding two clinical trials, MarketWatch

• Biden defends Trump-era drug pricing rule on copay accumulators, STAT